ROI, or Return on Investment, serves as a crucial metric for assessing the profitability of real estate investments. It quantifies the financial return relative to the investment's cost. The simplicity of calculating ROI makes it a widely used tool for evaluating various investments.

Why is ROI a Popular Measure of Profitability?

Simplicity:

ROI is straightforward to understand and calculate for almost any investment. This simplicity allows investors to quickly compare the profitability of different ventures.

Snapshot Analysis:

It offers a financial "snapshot" of an investment, aiding in decision-making regarding buying, selling, or adjusting a portfolio.

Importance of ROI in Real Estate

While ROI provides a quick overview of an investment's profitability, it may not capture all complexities involved in real estate. Despite its simplicity, ROI is crucial for:

Quick Assessment:

Investors can gauge the "health score" of potential investments, identifying properties with cash flow issues or negative ROI.

Decision-Making:

When aligned with overall investment goals, ROI calculations help in making informed decisions and building a robust real estate portfolio.

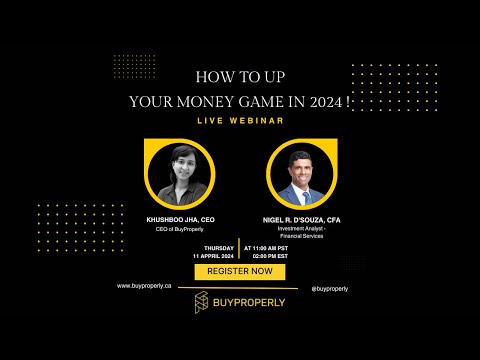

BuyProperly's Approach to ROI

At BuyProperly, we prioritize ROI calculations as a benchmark for property profitability. Most investors can anticipate projected annual returns ranging from 10-40%.

Read about How to Calculate ROI in Real Estate to Maximize Your Profit | Buyproperly